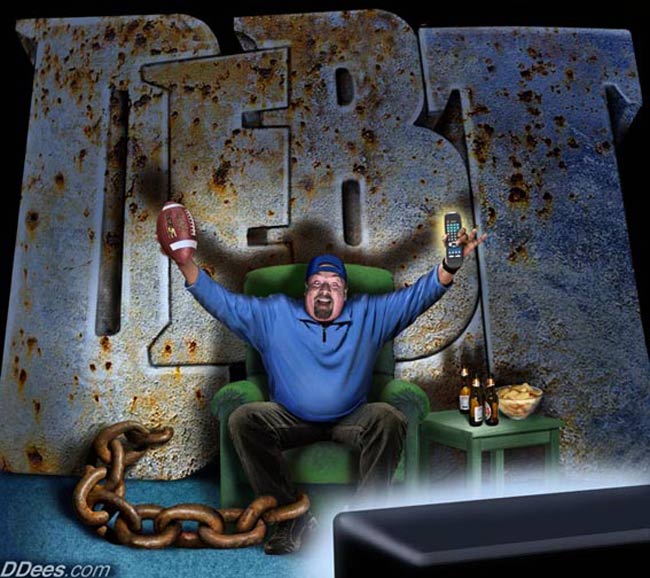

Debt trap series: Totally indebted

Visuals by Stanka / written by Alen Mischael Vukelić

Debt trap for beginners

These days we all got to know, that bankers are certain kind of people who are holding hostage innocent citizens, even whole countries, with huge piles of dept. We’ve learned, that they have enslaved us, taken our freedom away and have made us work in exchange for peanuts.

For me, it was a true financial awakening. I didn’t know any of this. When I needed a loan for a car or a business, I’d go to a bank, and if my credit got approved, I celebrated it as if I had gotten the cash for free. I never worried about interest rates, small printings, or about the fact where the money actually came from. But I know now.

Before and after the crash

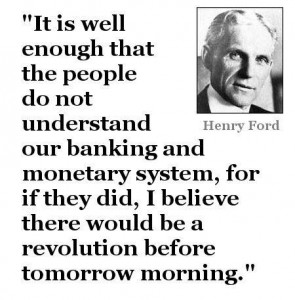

This crisis is just wonderful. Never before have I learned this much about banking, monetary policies, bonds, financial markets – and my role in it – as in these recent years. It never interested me. However, if somebody explained to me in school how this system works, it would probably be different.

But for some reason, they never told me. I know about every medieval war battle and chromosomes, but I don’t know how the banking system works.

When you look at all the available data, it’s almost impossible not to hate banks or at least to have an unfavorable attitude towards them. What stunned me the most was the term “fractional reserve banking system”, which means that banks can lend out at least ten times the amount of money than they actually possess.

A feeling of deception aroused in me. I felt cheated, because I thought that they had the money there – in the bank – as real tangible cash, and that they were managing people’s deposits by lending out the same money as credit to potential borrowers.

However, this is not the case. I will not go into detail, because it has widely been reported across the Internet, but not by the regular media. Why? Oh, the media owns money to the banks, and they might lose revenue from advertisement. If you have such obligations, you simply don’t do anything what would displease your customers.

You don’t learn this in school

The banks have enormous power, because they can multiply money they don’t have; I mean physically it is nonexistent. It is virtual money, existing only on computer screens. Here is a very simplified example. Let’s say you’ve inherited $/€/£100.000 from your uncle, and you’ve decided not to spend the money, but to keep it as a deposit in a bank.

The banks have enormous power, because they can multiply money they don’t have; I mean physically it is nonexistent. It is virtual money, existing only on computer screens. Here is a very simplified example. Let’s say you’ve inherited $/€/£100.000 from your uncle, and you’ve decided not to spend the money, but to keep it as a deposit in a bank.

You are very pleased because you are getting a 4% annual interest on that amount, and the bank clerk keeps shaking your hand, congratulating you on the wonderful deal you’ve just made. The truth is, that the amount you will be making is peanuts in comparison to what they will be making.

Your 100.000 gives them the right to hand out credit worth at least one million in ‘digital cash’ on which they will on average earn around 6% per year. The translation is that you will be making around 4000 and they around 60.000 from your money – at least.

These are profit ranges which are unimaginable to us. I think that before all of this information came out, banks had a reputation of – more or less – conservative integrity. Some sort of holy grail for money-keeping. Not anymore, and I believe they will hardly regain their reputation back to where it was before.

It will never be the same

Many people across Europe, the Americas, and elsewhere would like it to be as it was before the crisis, when there were no pay cuts, no pension cuts, and lower living costs, and so on. That’s quite impossible, because it would mean that nothing had changed.

I wouldn’t want to live in the same deception again. This is a great possibility to clean up this mess, which has accumulated over the years, and I wouldn’t miss it, for nothing.

This nonsense must stop. I remember conversations, where people believed that they had “bought” a house. No they didn’t, the bank did. And when they believed that the house is worth the price they paid.

What most people fail to see is that they will actually be paying this price plus all the interest, every year for the next 25 years (depending on what loan they have), and all the equipment for the house, and even that will probably be financed with a loan, as well.

When you step out of dept, you are free. You can do whatever you want. You can even change your mind; change a decision you’ve made. When you are in dept, you can’t. You’ve made a commitment and now you are stuck.

Do we really need all of this?

All these stupid possessions which we accumulate as if possessed, for what? Somebody implanted us the idea, that we must ‘have’ things. We can’t just use them; we got to have them. They must be ours.

The problem is, that you have to pay for all this and work all day to call this crap “your own”. Yes, I also believe that we deserve to live in a nice house with a vegetable garden BUT not for the price of slavery to banks and governments for the rest of our lives.

We should not forget, that without us, there is no bank, no government, no nothing. It is us, who want this; we are keeping this system alive by buying stuff we don’t need, indepting ourselves with mortgages for completely overpriced real estates, which naturally belong to us. We are the only idiots on this planet, who pay for their homes.

If I can’t get it for free, I don’t need it and if there are more who think like that, the house prices will go down to zero. Until then, enjoy yourself somewhere else for free, if you can. Maybe you have to move somewhere, sell something, or rent something. So what, better than conforming to this stupid system – totally indebted.

organictalks.com